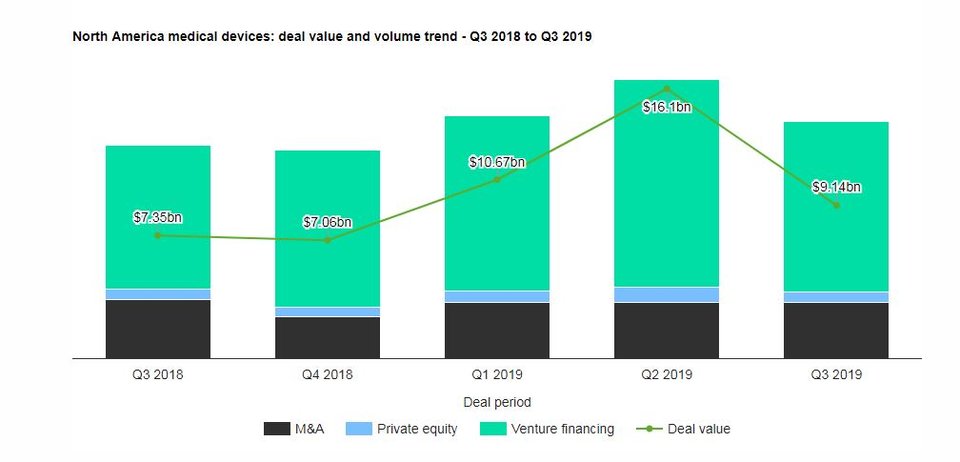

North America’s medical devices industry sees a rise of 0.8% in deal activity in Q3 2019

A total of 243 deals worth $9.14bn were announced for the region during Q3 2019, against the last four-quarter average of 241 deals. Of all the deal types, venture financing saw most activity in Q3 2019 with 175, representing a 72.02% share for the region.

In second place was M&A with 57 deals, followed by private equity deals with 11 transactions, respectively capturing a 23.5% and 4.5% share of the overall deal activity for the quarter.

In terms of value of deals, M&A was the leading category in North America’s medical devices industry with $7.48bn, while venture financing and private equity deals totalled $1.34bn and $329.1m, respectively.

North America medical devices industry deals in Q3 2019: Top deals

The top five medical devices deals accounted for 69.3% of the overall value during Q3 2019.

The combined value of the top five medical devices deals stood at $6.34bn, against the overall value of $9.14bn recorded for the quarter.

The top five medical devices industry deals of Q3 2019 tracked by GlobalData were:

1) Exact Sciences’ $2.8bn acquisition of Genomic Health

2) The $1.17bn acquisition of BioTek Instruments by Agilent Technologies

3) Siemens Healthineers’ $1.1bn acquisition of Corindus Vascular Robotics

4) The $775m acquisition of Hu-Friedy Manufacturing by Cantel Medical

5) Stryker’s acquisition of GYS Tech and Mobius Imaging for $500m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Europe’s medical devices industry sees a rise of 12.7% in deal activity in Q3 2019

Europe’s medical devices industry saw a rise of 12.7% in overall deal activity during Q3 2019, when compared to the four-quarter average, according to GlobalData’s deals database.

A total of 80 deals worth $627.42m were announced for the region during Q3 2019, against the last four-quarter average of 71 deals. Of all the deal types, venture financing saw most activity in Q3 2019 with 40, representing a 50% share for the region.

In second place was M&A with 29 deals, followed by private equity deals with 11 transactions, respectively capturing a 36.3% and 13.8% share of the overall deal activity for the quarter. In terms of value of deals, venture financing was the leading category in Europe’s medical devices industry with $539.4m, while M&A and private equity deals totalled $80.26m and $7.76m, respectively.

Medical devices industry deals in October 2019 total $762.12m globally

Total medical devices industry deals for October 2019 worth $762.12m were announced globally, according to GlobalData’s deals database. The value marked a decrease of 65.1% over the previous month and a drop of 83.3% when compared with the last 12-month average of $4.55bn. In terms of number of deals, the sector saw a drop of 12.9% over the last 12-month average with 108 deals against the average of 124 deals.

Elsevier acquires 3D4Medical

Global information analytics company Elsevier has acquired Irish anatomical education company 3D4Medical for just under €45m.

Although the terms of the agreement have not been officially announced, 3D4Medical’s investor the Malin Corporation has issued a release indicating that its 38% stake in the company had generated net proceeds of €17m, valuing the transaction at €44.7m.

Biolidics agrees with Sysmex to develop LDT

Singapore-based medical technology company Biolidics has signed a definitive agreement with Japan-based haematology products provider Sysmex for the joint development of laboratory-developed tests (LDT) to diagnose cancer. Since 2016, the two firms have been collaborating in the research and development of laboratory assays in circulating tumour cells.

Indian stent-maker SMT acquires majority stake in Zarek

Indian medical devices firm Sahajanand Medical Technologies (SMT) has acquired a majority stake in Brazil-based medical devices solution provider Zarek Distribuidora De Produtos Hospitalares for an undisclosed amount. SMT made the acquisition through its Irish subsidiary.