Market insight in association with

Intuitive Surgical: where do we go from here?

Intuitive Surgical is undoubtedly the market leader within the robotic surgical market; however, its stock experienced a decline in the past month.

At the beginning of May, the Intuitive Surgical (ISRG) stock was at $497.05, and on 28 May it was selling at $471.22; this decrease can be attributed to its Q1 performance, which was lower than market estimates.

There are two main reasons for ISRG’s steady decline in earning profits. First, the company’s robotic system has a very high cost, and the second is the increased competition within the robotic surgical space.

The high cost associated with ISRG’s da Vinci Robotic Surgical System is progressively becoming an issue as most large hospitals within the US have already purchased these systems at a hefty $2m price. Smaller hospitals meanwhile are unable to justify the price to install the da Vinci system. Thus Intuitive Surgical will need to find viable solutions to stimulate growth, and the major hindrance to that goal is its price point.

Additionally, numerous multinational companies are active within the robotic surgical space including Stryker, Medtronic, and TransEnterix. These companies are carving out a market share by focusing on other surgical procedures, such as Stryker’s MAKO system, which focuses on orthopaedic surgeries.

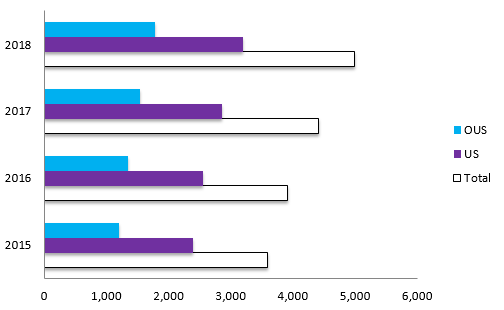

Nonetheless, Intuitive has reported an increasing installed base; for the past four years, its new sales have grown year over year. Estimated new sales have increased from 2016 with 322 units to 490 units in 2017 and 577 units in 2018, globally (excluding refurbished and returned products).

Source: GlobalData

The US-installed base increased at a compound annual growth rate of 11.7% from 2017–2018 while the OUS increased at 15.7%, demonstrating there is still room for growth with the current ISRG sales model. However, domestically the company will need to increase its installed base amidst increased competition and pricing pressures.

For more insight and data, visit the GlobalData Report Store.