Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 14 April

After months of decline, GDP estimates for many countries have turned positive.

India is projected an impressive 12.5% growth in 2021 ahead of China, which is forecasted to grow by 8.6% in 2021.

6%

The IMF has raised world economic growth forecast for 2021 to 6%, from its earlier projection of 5.5% in January.

6.7%

According to the OECD, the unemployment rate in OECD nations stood at 6.7% in Feb 2021, marginally down from 6.8% in Jan 2021.

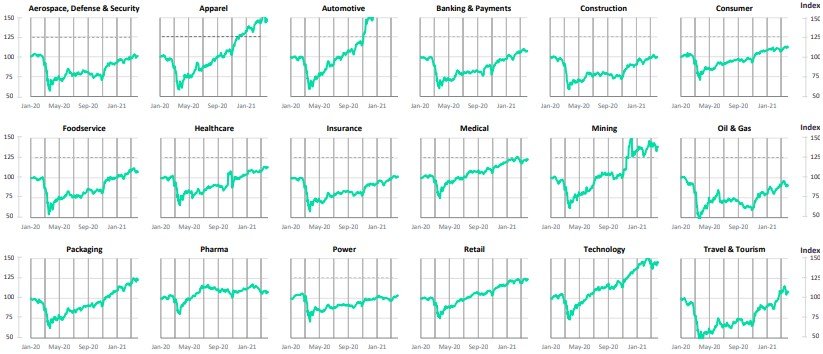

Impact of Covid-19 on equity indices

- SECTOR IMPACT: MEDICAL DEVICES -

Latest update: 08 April

financial impact and relief

59%

The number of polled respondents that said they would like healthcare workers to continue using PPE after the pandemic to the same degree they are using it during the pandemic.

70%

GlobalData estimates that a 70% reduction in ophthalmic procedure volumes occurred in Q2 2020, as a result of Covid-19.

General surgery devices

During Q2 2020, 40%-80% of elective surgeries were cancelled due to measures put in place to prevent the spread of Covid-19.

By Q3 2020, elective surgeries resumed and were being performed at 70%-90% of pre-Covid-19 rates, depending on the region. However, an exception was the UK, where elective surgeries were only being performed at 30%-40% of pre-Covid-19 levels during this time.

Therefore, most medical devices companies began to recoup lost revenue during H2 2020 as sales increased due to a resumption of elective surgeries.

As such, overall sales declines for 2020 were not as severe as initially expected. For example, Medtronic reported revenue losses for its Minimally Invasive Therapies Group of only 14% for the entire year. Similarly, Johnson & Johnson’s Medical Devices business declined only 11% year-over-year.

This range of sales decline was reported by companies including Stryker, Boston Scientific, Zimmer, Abbott, and many others.

Key Medical device market developments