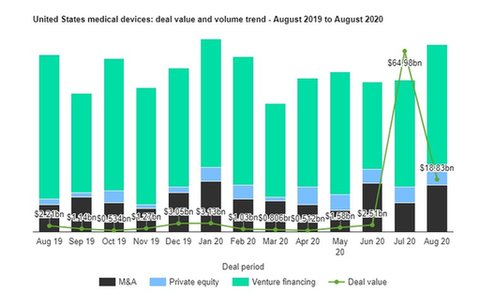

US medical devices industry sees a rise of 18.5% in deal activity in August 2020

A total of 96 deals worth $18.83bn were announced in August 2020, compared to the 12-month average of 81 deals.

Venture financing was the leading category in the month in terms of volume with 62 deals that accounted for 64.6% of all deals.

In second place was M&A with 24 deals, followed by private equity with ten transactions, respectively accounting for 25% and 10.4% of overall deal activity in the country’s medical devices industry during the month.

The top five medical devices industry deals of August 2020 tracked by GlobalData were:

1) Siemens Healthineers’s $16.4bn acquisition of Varian Medical Systems

2) The $825m private equity deal with NN by ASP Navigate Acquisition

3) Koninklijke Philips’ $360m acquisition of Intact Vascular

4) The $270m venture financing of Freenome by Andreessen Horowitz, Bain Capital Life Sciences, BrightEdge Fund, Catalio Capital Management, Colorectal Cancer Alliance, Cormorant Asset Management, Data Collective Venture Capital, EcoR1 Capital, Farallon Capital Management, Fidelity Management & Research, GV Management Co, Janus Henderson Investors, Kaiser Permanente Ventures, Novartis Venture Fund, Perceptive Advisors, Polaris Partners, RA Capital Management, Roche Venture Fund, Rock Springs Capital Management, Sands Capital Management, Section 32, Soleus Capital Management and T Rowe Price Associates

5) Catalyst Health Ventures and Fidelity Management & Research’s venture financing of Conformal Medical for $85m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Todos Medical signs equipment financing deal with AID Genomics

Israel-based in vitro diagnostics company Todos Medical has entered an implementation and equipment financing partnership with a multi-national genomic R&D company AID Genomics to scale up its Covid-19 PCR testing capabilities.

As part of the agreement, AID Genomics will fund the purchase of the necessary equipment to enable Todos’ clients to meet their capacity requirements.

It will also help Todos to implement best practices to scale up and optimise sample accessioning and data reporting software.

Medtronic to acquire medical device company Avenu Medical

Medical technology company Medtronic has announced the acquisition of US-based privately held medical device company Avenu Medical.

The terms of the transaction were not revealed.

Avenu Medical specialises in the minimally invasive endovascular creation of arteriovenous fistulae for end-stage renal disease patients undergoing dialysis.

AV fistulae facilitate dialysis therapy and are created by connecting a vein and artery in the arm.

Avenu Medical’s Ellipsys Vascular Access System is a single-catheter, ultrasound-guided device. The device inserts the catheter through the skin into the arm to create a durable AV fistula.

V-Wave raises $98m to support further development of cardiac shunt

Israeli cardiovascular device company V-Wave has closed a Series C extension of nearly $98m to support the further development of its V-Wave Implantable Interatrial Cardiac Shunt.

Illumina to acquire Grail in a deal worth $8bn

Swiss Medical Group acquires CoreMedica Europe

Swiss Medical Group has acquired CoreMedica Europe for an undisclosed amount to expand its footprint in Europe and the rest of the world.

Switzerland-based CoreMedica Europe specialises in a mass spectrometry technology platform, which identifies a patient’s nutritional profile using dried blood.