Hospital adoption of robotic surgery is accelerating worldwide. According to an iData Research report (March 2025), more than 6,700 robotic surgery systems are currently installed globally. Market forecasts estimate the size of the global surgical robotics market at approximately $12.49 billion in 2025, with potential growth to $45.93 billion by 2034–2035, depending on regional uptake and technology integration.

Artificial intelligence (AI) is a major driver of this expansion. A 2025 systematic review led by Dr Jack Ng Kok Wah of Multimedia University (MMU), Cyberjaya, Malaysia, published in the Journal of Robotic Surgery, analysed 25 peer-reviewed studies published in the period 2024–2025. It found that AI-assisted robotic procedures reduced operative time by an average of 25%, decreased intraoperative complications by 30%, improved targeting precision by around 40% and shortened patient recovery times by roughly 15% compared with conventional manual surgery.

Dominican Republic free zones: key hubs of medical device manufacturing and export. Credit: hyotographics / Shutterstock.com

According to Dr Ng, a recognised expert in AI-assisted and robotic surgery, “AI-assisted robotic surgery is no longer about adding bells and whistles. These procedures deliver substantial gains in efficiency and safety, cutting operation durations by a quarter and reducing intraoperative complications by nearly a third. Those are not marginal improvements – they translate directly to enhanced patient outcomes and significant resource savings.”

Advances in technology and interfaces

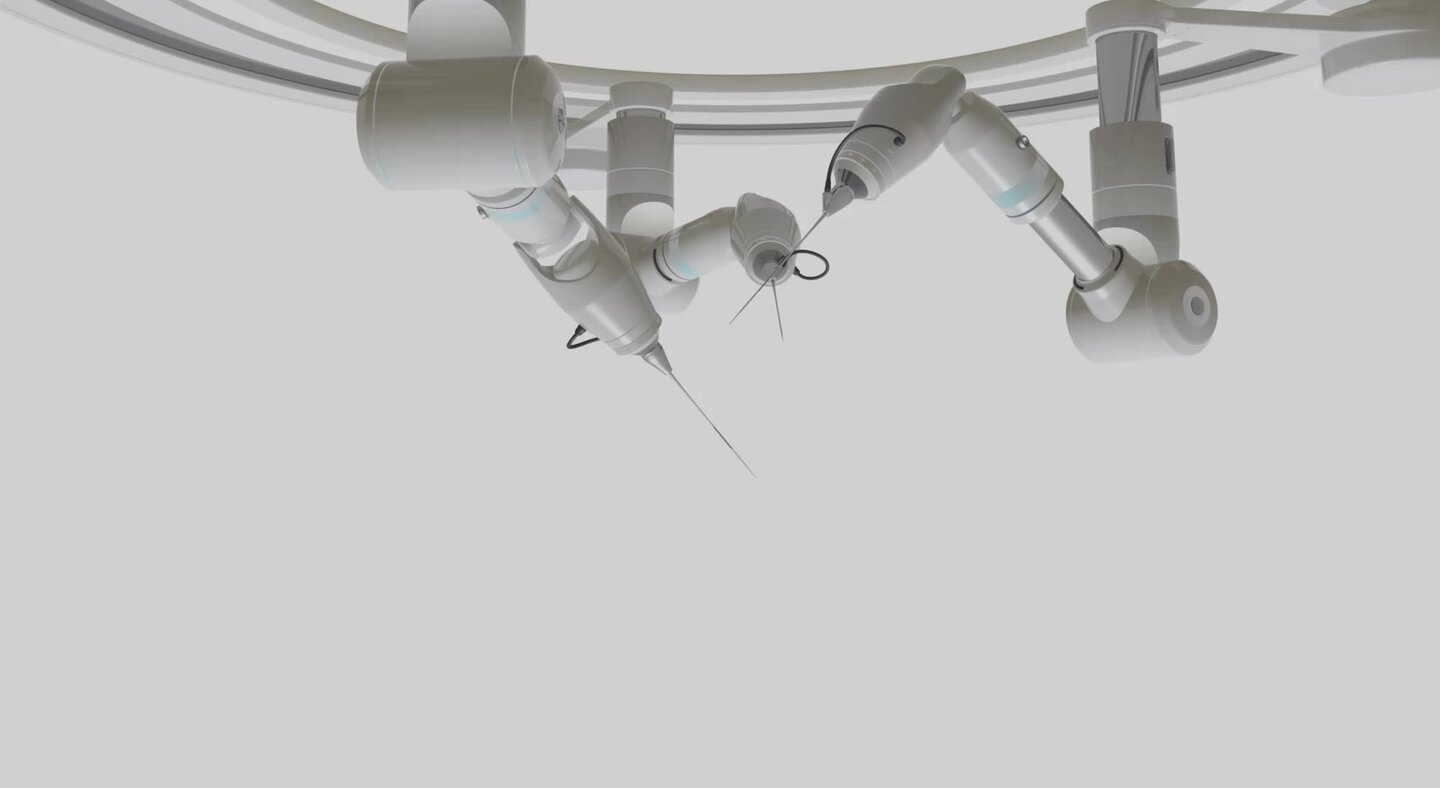

AI is driving significant advances in surgical robotics, enhancing automation, user interfaces and training methodologies. As AI models take on increasingly complex tasks, semi-autonomous camera control systems are now able to adjust the field of view in laparoscopic surgery without manual intervention, marking a clear step toward greater surgical autonomy and operational efficiency.

Building on this, natural user interfaces (NUIs) such as gesture control, voice commands, and AI-vision overlays are being refined to create more intuitive interactions between surgeons and robotic systems. Recent studies indicate that monitoring cognitive workload, including through eye tracking and heart rate, can allow robots to anticipate surgeon intent, further improving precision and reducing mental strain. Alongside these operational innovations, extended reality (XR) simulators are transforming surgical training: a meta-analysis published in early 2025 found that novice surgeons trained with XR completed robot-assisted tasks faster and achieved higher quality scores (as measured by the Global Evaluative Assessment of Robotic Skills (GEARS) tool) compared with traditional methods. Together, these advances in technology and interfaces illustrate how AI is reshaping surgical practice by improving efficiency, safety and skill acquisition in a single integrated framework.

Bhavik Patel, president, IQVIA Commercial Solutions

Global HRI ecosystem and market dynamics

The global HRI provider ecosystem has grown steadily, with more than 30 established manufacturers and operators active worldwide in 2025, reflecting a 10–15% annual increase since 2019. Integrated robotic system manufacturers such as Intuitive Surgical, CMR Surgical and Medtronic focus on general-purpose minimally invasive surgery platforms, covering urology, gynaecology and soft tissue procedures, with Intuitive maintaining the largest market share and challengers gaining regional traction. Orthopaedic and arthroplasty robots, led by Stryker, Zimmer Biomet and Smith & Nephew, concentrate on implant planning, guided bone cutting and semi-autonomy in alignment, and command a significant share in this market. Navigation and interventional imaging systems from Medtronic, GE HealthCare and Accuray specialise in neurology, spine and image-guided procedures. Meanwhile, start-ups and software developers such as Proprio, Activ Surgical, Surgical Theater and Moon Surgical are driving innovation in AI-assisted intraoperative guidance and 3D navigation, and ecosystem providers including Johnson & Johnson (J&J), NVIDIA, AWS and Microsoft focus on connected operating theatre platforms, analytics, simulation and algorithm deployment. Together, these actors are driving innovation and preparing the sector for the next generation of surgical solutions.

Strategic partnerships driving innovation

Strategic partnerships have become a defining feature of the HRI sector, with dozens of collaborations between AI operators and robotic platforms announced in 2024–2025. Notable examples include the partnerships between J&J MedTech and NVIDIA on the Polyphonic digital surgery ecosystem, and between NVIDIA and GE HealthCare on autonomous diagnostic imaging and the Isaac for Healthcare platform, and CMR Surgical’s $200 million funding round to accelerate the expansion of its Versius system. These partnerships take five main forms: co-development, such as NVIDIA and GE HealthCare’s autonomous imaging and simulation solutions; platform integration, as with J&J and NVIDIA; distribution and go-to-market collaborations, exemplified by Proprio with regional distributors such as LifeHealthcare; strategic acquisitions or equity stakes, including Zimmer Biomet and Monogram; and funding initiatives, such as the J&J Polyphonic AI Fund grants and innovation challenges. These collaborations are accelerating AI adoption, technological integration and market expansion in surgical robotics.

KPI / Item | Pre-digital baseline / Annual cost w/o monitoring | With monitoring (2025 median) | Impact / Savings |

Alert-to-action time | 5–7 days | < 24 hours | Faster response |

Expedite shipments (per month) | 12 | 4 | Reduced by 66% |

Stockout days (per quarter) | 6–8 days | 1–2 days | Improved continuity |

ROI (Resilinc case study) | n/a | “Millions saved” (undisclosed) | Positive impact |

Expedite airfreight | $3.5m | $1.0m | $2.5m saved |

Production downtime | $2.0m | $0.7m | $1.3m saved |

Platform subscription (avg.) | — | $0.8m | — |

Net impact | — | — | +$3.0m |

Challenges to overcome

Despite rapid adoption, the use of HRI in the operating theatre faces persistent technical, economic and regulatory challenges. Technical reliability in vivo remains a key hurdle, as the current AI-powered robotic systems struggle with real-time adaptation to soft tissue deformations, unexpected anatomical variations, bleeding and motion from breathing or pulsation. Haptic feedback is still imperfect, and detecting tissue consistency or unanticipated resistance remains difficult. Although preclinical studies, for example in pig organ models, show promise, these trials do not replicate live human tissue responses, leaving critical uncertainties in relation to fully autonomous or semi-autonomous tasks. Economic and cost barriers also constrain deployment: developing a class II AI module typically requires several million US dollars for R&D, validation and regulatory submission, while the development of a fully integrated robotic platform, including hardware, software and pilot trials, can cost tens to hundreds of millions in US dollars. Hospitals have to absorb acquisition, maintenance, calibration, staff training and upgrade costs, limiting adoption in low- and middle-income settings. Reimbursement remains inconsistent, further complicating procurement decisions. And finally, there are the problems of training, trust and regulatory frameworks. Steep learning curves require structured programs, simulation and XR tools. Surgeons have to rely on interfaces performing predictably under pressure. Regulatory and standardisation gaps persist, particularly for autonomous functions. Legal liability in mixed human-robot operations and ethical concerns – equity of access, transparency and oversight – require harmonised safety standards, cybersecurity, data privacy and clear regulatory guidance. Without comprehensive frameworks, adoption and innovation may be slowed despite the demonstrable clinical benefits.

Industrial trajectory and future drivers

The industrial deployment of AI-powered HRIs will hinge on three strategic levers shaping the next decade. The first lever is hardware–software decoupling through modular architectures. By separating robotic arms from plug-in AI modules, manufacturers are laying the groundwork for scalable innovation. This approach, which can already be seen in modular platforms such as Medtronic’s Hugo and CMR Surgical’s Versius, is expected to lower barriers to entry, accelerate iterative software development and expand adoption in diverse clinical settings. The second lever lies in the consolidation of digital operating theatre ecosystems. Integrated platforms, as exemplified by J&J’s Polyphonic initiative with NVIDIA, will enable seamless deployment of third-party algorithms, facilitate interoperability across devices and accelerate global commercialisation of AI-driven applications.

The third lever is the rise of AI-first solutions, particularly in intraoperative guidance and computer vision. Companies such as Proprio are opening new regulatory and commercial pathways, as demonstrated by recent US Food and Drug Administration (FDA) 510(k) clearances in 2025. These actors illustrate how AI-centric design can shorten distribution timelines, attract investment and broaden access to surgical robotics. Together, these three levers reveal not only the present direction of the industry but also the foundations for its future expansion, provided that economic and regulatory challenges are addressed.

Three key challenges in autonomous medical technology

As healthcare technologies gain autonomy, three critical areas – regulatory, ethical and legal – demand careful attention.

Regulatory: As of 2025, no system has full approval for autonomous surgery on humans, and regulators continue to require human oversight for critical tasks. Promising preclinical studies, such as the Johns Hopkins pig organ research, remain a long way from human application.

Ethical: Patients must be informed when AI or robotic systems influence decisions, such as camera movement or surgical tool navigation. Transparency in responsibility for adverse events is essential.

Legal: Accountability for semi-autonomous systems is complex. Liability may involve the surgeon, manufacturer, software developer or hospital, highlighting the need for clear legal frameworks.

Technological evolution in surgical robotics

2015–2020: Telemanipulation dominates operating theatres, enabling surgeons to perform procedures remotely with precise manual control.

2021–2025: Semi-autonomous modules emerge, including AI-guided camera systems and tool-tracking technologies that enhance precision and reduce workload.

2025: Natural user interfaces (NUIs) gain traction – voice, gesture, gaze and cognitive load recognition allow more intuitive interaction between surgeon and robot.

2030 and beyond: Advanced integration of digital twins, extended reality (XR) training and modular, cost-efficient robotic platforms is expected to transform surgical workflows and scalability.

Natural interaction: the next frontier

Natural human-robot interaction refers to interfaces that allow surgeons to communicate with robotic systems in intuitive ways, such as spoken commands, gesture recognition, gaze tracking and real-time scene understanding. The 2025 ‘Perception Agent’ study introduces a hybrid system that combines large language models, segmentation models and any-point tracking to allow the robot to understand and respond to ‘unseen’ objects (such as gauze or instruments) in a dynamic way, enabling more flexible, safer intraoperative assistance.

Failure to ensure the US government and healthcare providers in the US have the same information as our European counterparts poses a risk to providers, patients, caregivers and consumers in the US.

Michelle Tarver, director of the FDA’s Center for Devices and Radiological Health (CDRH)

Caption. Credit:

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.